As the second-biggest UK car dealer by turnover (according to AM-online), Arnold Clark outperforms competitors in many areas. The brand name alone receives around 4.4 million searches annually—almost four times more than its nearest competitor.

However, despite its popularity, Arnold Clark has outperformed Evans Halshaw by over 1 million non-branded visits per year due to a key difference in their approach to search optimisation, according to our analysis below.

Arnold Clark may have the bigger name, but an estimated 70% of its organic traffic comes from branded keywords. In contrast, only 45% of Evans Halshaw’s traffic is thought to come from brand-specific searches, indicating it outperforms in general search terms. When we think about how customers shop for their next car, explained below, it’s clear how important it is to rank for these broader, non-branded keywords.

Read our full study below and learn which car dealerships are driving ahead in search – and what changes could be made to stop others from slowing down.

Which dealerships are accelerating to success in organic search?

We analysed the top UK dealerships to find out who’s receiving the most organic search without relying on brand. Here are the key highlights and findings:

- Evans Halshaw receives 3x more traffic than Marshall Motors Group, JCT 600, Vertu Motors and Sytner combined

- Arnold Clark could make one change to close the 1 million traffic gap between them and Evans Halshaw

- Group 1 Auto is driving forward with Digital PR, but Vertu Motors is slowing down

- Stratstone’s hit the brakes in search with as its own sites steal traffic from each other

- The UK’s biggest car dealer comes in last place when it comes to organic traffic

The table below estimates how much non-branded traffic each car dealership receives each year, according to leading SEO tool Ahrefs. This means the amount of traffic a site gets from customers who have searched for non-branded keywords like ‘car dealership near me’. As you can see, this results in a significant amount of traffic each year for each business.

Notes about our data (skip ahead if you just want the interesting bits!):

How we determine non-branded organic traffic: we’ve taken an average figure of all traffic for the past 12 months and removed any visits from branded keywords.

To also make things fair, we’ve only considered sites where customers are able to enquire about a vehicle. For example, we’ve excluded Pendragon’s corporate site for this reason and opted to analyse commercial sites owned by the group, including Evans Halshaw and Stratstone. We’ve also left out sites like TrustFord which are dedicated to one manufacturer.

Why does this matter for car dealerships?

92% of car buyers start their journey online, researching purchase methods, watching video reviews and comparing prices. That’s long before they’ve even thought about heading to a car dealer – and even then, visits to dealerships are down from previous years, and 62% of automotive customers would consider ordering their car online.

Brand is extremely important to be successful in Search, and I’ve already talked about its importance for automotive brands here. In general, the bigger your brand, the more likely you are to win online. However, it’s not something that can be solely relied on as the only way to drive customers to your site. That’s why ranking for non-branded, generic keywords is so important, especially when we think about how customers find their next car.

When shoppers start research, ‘people look for information about a category’s products and brands, and then weigh all the options’, according to Google’s consumer insights. When this is applied to car purchases, we know customers are looking for one or more of the following:

- Manufacturer and/or model they trust

- Body/engine type that suits their lifestyle

- A price point that fits their budget

Put more simply, customers search for a car that fits their requirements. Where that car comes from, and which dealership, is much further down the list of research priorities.

So, if you rely solely on brand, your site will be far behind the rest, with competitors getting in front of customers through more general keywords long before you do.

Arnold Clark could make one change to close the 1 million visits gap between them and Evans Halshaw

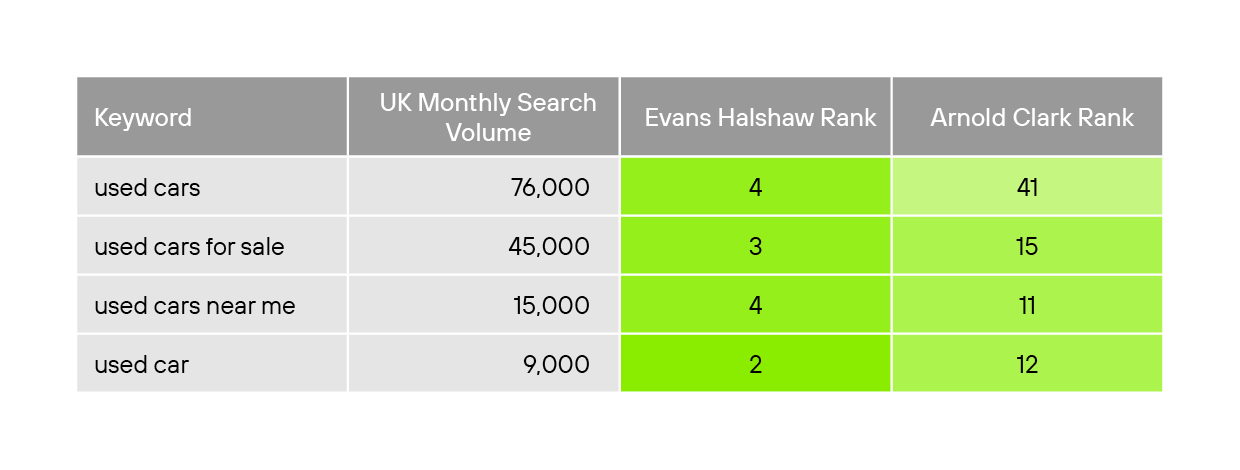

How can Evans Halshaw receive 1 million more visits than Arnold Clark? The key divider between these two brands is how they manage their used car products. Both sites rank well for ‘used’ keywords, generating over 3 million UK searches per month (Ahrefs). But Arnold Clark is missing out on key traffic drivers – let’s take a look.

As you can see, there’s a huge difference in keyword rankings for these big terms, which could potentially be resolved very easily by Arnold Clark with a simple SEO change.

Currently, Arnold Clark’s main page for used cars is no-indexed, which means it can’t be found by search engines. The brand does have an existing indexed page, but it doesn’t rank particularly well. Major internal linking opportunities around the site, such as the main nav, are directed to the no-indexed version.

It’s not clear why Arnold Clark would choose this route – the indexed page is slightly less commercial in that the deals aren’t displayed immediately, but they have plenty of offers and useful content. It’s not obvious as to why Arnold Clark would make this decision, but it’s certainly costing the site a decent amount of quality traffic. It’d also be a relatively simple fix that could likely allow them to overtake Evans Halshaw.

Group 1 Auto is driving forward with Digital PR, but Vertu Motors is slowing down

From a brand perspective, Group 1 Auto is one of the smaller dealerships – its main branded keyword only receives around 1.3k searches per month in the UK. That also makes sense when you consider around 39% of its traffic is branded, indicating it relies much more on non-branded keywords to bring in customers compared to its bigger competitors.

When you consider the amount of non-branded traffic the site generates, it’s a considerable feat, as Group 1 Auto places fifth overall in the rankings and not far behind premium dealer Stratstone.

One of the reasons Group 1 Auto is so successful without being a huge name can be linked to its recent increase in Digital PR efforts. Their in-house motoring experts have been providing advice online for common car questions and getting the brand’s name in multiple, relevant automotive news stories recently.

Let’s compare this to another brand, Vertu Motors. Branded searches are 8x greater for Vertu Motors versus Group 1 Auto, and they also have double the number of domains linking to them – 439 for Vertu Motors and 218 for Group 1 Auto. Judging by these numbers alone, we’d expect Vertu Motors to be a much more successful site from an SEO perspective.

However, on our list of car dealerships ranked by non-branded organic traffic, Vertu Motors places ninth. One of the reasons for this could be its reduced Digital PR output – it doesn’t look like there are any recent automotive stories to which their experts have contributed. The site also has a significant number of backlinks from sports and football publications as a result of their numerous sponsorships.

More backlinks don’t always mean better, and in Vertu Motor’s case, it appears that the brand needs to create or contribute to more automotive stories before it can overtake competitors.

Stratstone’s hit the brakes in search as its subdomains steal traffic from each other

Stratstone’s decision to have two different subdomains isn’t uncommon, as this is often done for scalability reasons to handle high volumes of traffic, for server maintenance, or because sites have different purposes (e.g., a commercial site and a blog site). Stratstone’s primary site uses the www prefix, whereas its secondary site uses www2. Both appear very similar in that they’re commercial sites where customers can enquire about a variety of cars, so it doesn’t appear that they’ve been set up for separate purposes.

While it may make sense from a technical perspective, it’s not clear if marketing and SEO were a consideration when Stratstone decided on having two subdomains. It’s concerning that the secondary site brings in around 30k organic visits per month and is growing. It outranks the primary Stratstone site for a number of high-intent local keywords like ‘Porsche Colchester’ (2.3k searches per month) and ‘BMW Milton Keynes’ (1.8k searches per month).

Perhaps it doesn’t matter to Stratstone if both sites convert equally as well – but in my experience, two different sites will never convert the same. From an SEO perspective, this could be managed better so all efforts are put into one site, making it the most authoritative version and giving Stratstone the opportunity to close the gap on competitors like Lookers.

The UK’s biggest car dealer comes in last place when it comes to organic traffic

Despite being top of the rankings of UK car dealers by turnover, it’s safe to assume Sytner’s success doesn’t come from organic search as it places 10th in our study.

The site may rank well for several local manufacturer terms, like ‘Mercedes Watford’ (2.1k searches per month), but it’s let down by underperforming for bigger general keywords like ‘used cars’ (74k searches per month).

To help this and drive significantly more traffic, Sytner could work on creating new landing pages or improving content to improve targeting these terms. Some of its manufacturer pages are difficult to find too, so it’s not easy for users to understand how to find their chosen brand and the different cars available by new, used or approved used offers. The site’s hierarchy could be made clearer with changes to its navigation and internal linking.

The performance of UK car dealerships in organic search highlights the importance of optimising for both branded and non-branded keywords. Evans Halshaw leads by leveraging general search terms to generate significantly more organic traffic than competitors like Arnold Clark, which still relies heavily on its brand presence. Small changes, such as fixing SEO issues like no indexing on key pages, could close this gap.

Meanwhile, Group 1 Auto’s investment in Digital PR is helping it compete against larger names, while Vertu Motors and Sytner show that even well-known brands can fall behind without a robust search strategy. To stay competitive, dealerships must focus on comprehensive SEO and digital marketing strategies that allow them to get more traffic than relying on brand recognition alone.

Get in touch and see how the automotive marketing experts at UpShift can boost your visibility online.

Get In Touch

required information